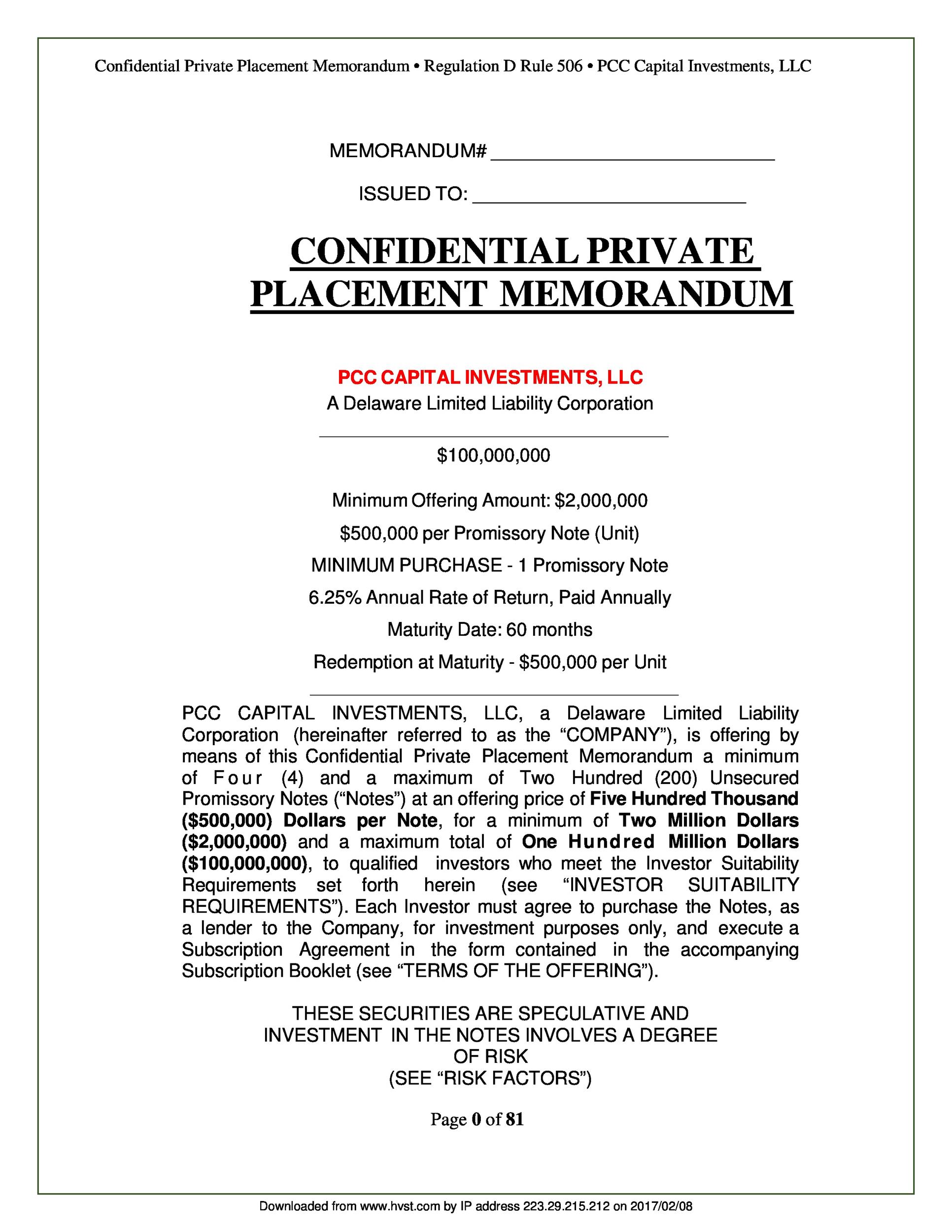

A private placement memorandum (PPM) is a legal document that outlines the terms and conditions of a private placement offering. It is typically used by companies seeking to raise capital from private investors. The PPM provides important information about the company, its management team, the investment opportunity, and the associated risks. In this article, we will explore the key elements of a private placement memorandum template and how to create an effective one.

1. Introduction

The introduction section of the PPM sets the tone for the document and provides an overview of the investment opportunity. It should include a brief description of the company, its industry, and the purpose of the private placement offering. This section should also highlight the potential benefits of the investment and why investors should consider participating.

2. Executive Summary

The executive summary is a concise summary of the entire PPM. It should provide a high-level overview of the investment opportunity, including key financial projections, market analysis, and the company’s competitive advantage. This section is often the first part of the PPM that potential investors read, so it should capture their attention and provide a compelling case for investment.

3. Company Overview

The company overview section provides detailed information about the company, its history, and its management team. It should include key information such as the company’s legal structure, location, and date of incorporation. This section should also highlight the qualifications and experience of the management team, as well as any relevant industry certifications or accolades.

4. Investment Opportunity

The investment opportunity section is the heart of the PPM. It should provide a detailed description of the investment opportunity, including the purpose of the capital raise, the proposed use of funds, and the expected return on investment. This section should also outline the terms and conditions of the investment, such as the minimum investment amount, the offering price, and any applicable fees or expenses.

5. Market Analysis

The market analysis section provides an overview of the target market and industry trends. It should include information about the size of the market, its growth rate, and any relevant market research or data. This section should also highlight the company’s competitive advantage and its ability to capture market share.

6. Financial Projections

The financial projections section provides detailed financial forecasts for the company. It should include projected income statements, balance sheets, and cash flow statements for at least three years. This section should also provide key financial ratios and metrics, such as return on investment and net present value. It is important to ensure that the financial projections are realistic and supported by sound assumptions.

7. Risk Factors

The risk factors section is an important part of the PPM as it discloses the potential risks associated with the investment. It should outline any known risks or uncertainties that could affect the company’s ability to achieve its financial projections. This section should also highlight any regulatory, legal, or competitive risks that could impact the investment.

8. Legal Considerations

The legal considerations section provides important legal disclosures and disclaimers. It should include information about the securities being offered, any restrictions on the transfer of the securities, and any regulatory or compliance requirements. This section should also highlight any potential conflicts of interest or related party transactions.

9. Subscription Agreement

The subscription agreement is a separate legal document that accompanies the PPM. It is used by investors to subscribe for the securities being offered. The subscription agreement should include important terms and conditions, such as the subscription price, the number of securities being purchased, and the investor’s representations and warranties.

10. Conclusion

The conclusion section of the PPM should summarize the key points and benefits of the investment opportunity. It should reinforce the value proposition and provide a call to action for potential investors. This section should also include contact information for the company or its representatives, so that investors can request additional information or express their interest in participating.

FAQs (Frequently Asked Questions)

1. What is the purpose of a private placement memorandum?

A private placement memorandum is used to provide potential investors with detailed information about an investment opportunity. It helps investors make informed decisions by disclosing key facts, risks, and financial projections.

2. Is a private placement memorandum legally binding?

No, a private placement memorandum is not a legally binding document. However, it is a crucial part of the investment process and helps protect both the company and the investors by providing clear and transparent information.

3. Can I use a template for my private placement memorandum?

Yes, using a template can be a helpful starting point for creating your private placement memorandum. However, it is important to customize the template to fit your specific investment opportunity and comply with applicable laws and regulations.

4. Do I need a lawyer to create a private placement memorandum?

While it is not required to have a lawyer create your private placement memorandum, it is highly recommended. A lawyer can ensure that the document meets all legal requirements, is properly structured, and provides adequate protection for both the company and the investors.

5. How should I distribute my private placement memorandum?

The private placement memorandum should be distributed to potential investors who have expressed interest in the investment opportunity. It is important to comply with securities laws and regulations regarding the offering and distribution of securities.

Conclusion

A well-crafted private placement memorandum is a critical tool for companies seeking to raise capital from private investors. It provides potential investors with the information they need to make informed investment decisions and protects both the company and the investors by disclosing key facts and risks. By following a comprehensive template and including all the necessary sections, companies can create an effective private placement memorandum that showcases their investment opportunity and attracts potential investors.

FAQs (Frequently Asked Questions) After The Conclusion

1. What is the purpose of a private placement memorandum?

A private placement memorandum is used to provide potential investors with detailed information about an investment opportunity. It helps investors make informed decisions by disclosing key facts, risks, and financial projections.

2. Is a private placement memorandum legally binding?

No, a private placement memorandum is not a legally binding document. However, it is a crucial part of the investment process and helps protect both the company and the investors by providing clear and transparent information.

3. Can I use a template for my private placement memorandum?

Yes, using a template can be a helpful starting point for creating your private placement memorandum. However, it is important to customize the template to fit your specific investment opportunity and comply with applicable laws and regulations.

4. Do I need a lawyer to create a private placement memorandum?

While it is not required to have a lawyer create your private placement memorandum, it is highly recommended. A lawyer can ensure that the document meets all legal requirements, is properly structured, and provides adequate protection for both the company and the investors.

5. How should I distribute my private placement memorandum?

The private placement memorandum should be distributed to potential investors who have expressed interest in the investment opportunity. It is important to comply with securities laws and regulations regarding the offering and distribution of securities.

Summary

A private placement memorandum is a crucial document for companies seeking to raise capital from private investors. It provides potential investors with detailed information about the investment opportunity, including the company’s background, financial projections, and associated risks. By following a well-structured template and including all the necessary sections, companies can create an effective private placement memorandum that attracts potential investors and helps them make informed investment decisions.