When it comes to running a successful cleaning service business, one of the essential aspects is efficient invoicing. An invoice not only serves as a record of the services provided but also acts as a crucial tool for ensuring timely payments and maintaining a healthy cash flow. In this comprehensive guide, we will explore everything you need to know about creating and managing cleaning service invoices.

1. Understanding the Importance of a Cleaning Service Invoice

A cleaning service invoice is a document that outlines the details of the services provided to a client, including the cost and any additional charges. It is a legally binding document that acts as a record of the transaction between the cleaning service provider and the client.

Here are some key reasons why a cleaning service invoice is important:

- Professionalism: An invoice demonstrates professionalism and helps build trust with your clients. It shows that you are a legitimate business and provides a sense of security.

- Transparency: An invoice clearly outlines the services provided and the associated costs. This transparency helps avoid any misunderstandings or disputes regarding the payment.

- Payment Tracking: Invoices serve as a useful tool for tracking payments and ensuring timely payment collection. They provide a clear record of the services provided and the corresponding payments.

- Financial Management: Invoices play a crucial role in managing your business finances. They help you keep track of your income, expenses, and overall cash flow.

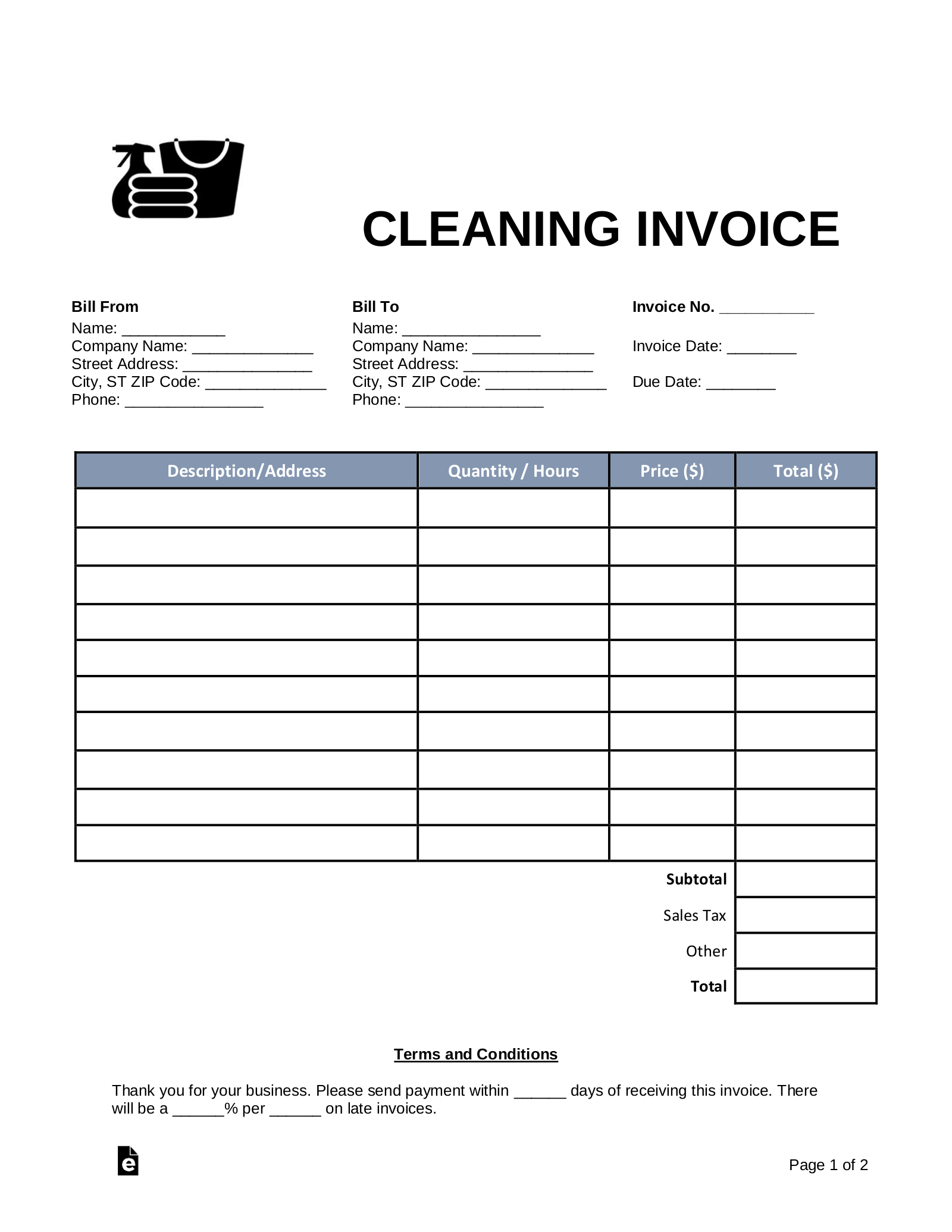

2. Essential Elements of a Cleaning Service Invoice

A well-designed cleaning service invoice should include the following essential elements:

- Header: The header of the invoice should include your business name, logo, and contact information. This helps establish your brand identity and makes it easy for clients to reach out to you.

- Client Information: Include the client’s name, address, and contact details. This ensures that the invoice is properly addressed and makes it easier for the client to identify the transaction.

- Invoice Number and Date: Assign a unique invoice number and include the date of issue. This helps in tracking and organizing invoices for future reference.

- Description of Services: Clearly outline the services provided, including the date and duration of the service. Be specific and include any additional charges or discounts applied.

- Itemized List: Provide an itemized list of the services rendered, along with their individual costs. This helps the client understand the breakdown of the charges.

- Total Amount Due: Calculate the total amount due, including any taxes or additional fees. Clearly state the payment terms and the due date.

- Payment Methods: Specify the accepted payment methods, such as cash, check, or online payments. Include the necessary details, such as bank account information or payment gateway links.

- Terms and Conditions: Include any relevant terms and conditions, such as cancellation policies, late payment fees, or refund policies. This ensures that both parties are aware of their rights and responsibilities.

3. Choosing the Right Invoice Template

Using a professionally designed invoice template can save you time and effort in creating your cleaning service invoices. There are plenty of online resources that offer customizable invoice templates specifically tailored for cleaning service businesses.

When choosing an invoice template, consider the following factors:

- Branding: Look for a template that allows you to add your business logo, colors, and fonts. This helps maintain a consistent brand image.

- Customizability: Ensure that the template is customizable to suit your specific requirements. This includes the ability to add or remove fields and adjust the layout.

- Clarity and Readability: The template should have a clear and legible format, making it easy for clients to understand the information presented.

- Automation: Some templates come with built-in automation features, such as auto-calculation of totals or automatic invoice numbering. These can significantly streamline your invoicing process.

4. Best Practices for Creating Cleaning Service Invoices

Creating effective cleaning service invoices requires attention to detail and adherence to best practices. Here are some tips to help you create professional and efficient invoices:

- Be Clear and Concise: Use simple and straightforward language to describe the services provided. Avoid jargon or technical terms that may confuse the client.

- Include Contact Information: Make sure your contact information is prominently displayed on the invoice. This makes it easier for clients to reach out to you in case of any queries or concerns.

- Set Clear Payment Terms: Clearly state the payment terms, including the due date and any late payment fees. This helps manage client expectations and ensures timely payment collection.

- Provide Detailed Descriptions: Describe the services provided in detail, including the date, duration, and any special instructions. This helps avoid any confusion or disputes regarding the scope of work.

- Use Professional Language: Maintain a professional tone throughout the invoice. Avoid using informal language or abbreviations that may undermine the credibility of your business.

- Include Terms and Conditions: Incorporate relevant terms and conditions, such as cancellation policies or refund policies. Make sure they are clearly communicated to the client.

- Proofread and Review: Before sending out the invoice, double-check for any errors or inconsistencies. A well-presented and error-free invoice reflects positively on your business.

5. Managing Cleaning Service Invoices

Managing your cleaning service invoices efficiently is crucial for maintaining a healthy cash flow and ensuring timely payments. Here are some strategies to help you stay organized:

- Establish a System: Implement a systematic approach to invoice management. This can include using dedicated software or cloud-based invoicing platforms.

- Automate Invoicing: Consider using automation tools to streamline your invoicing process. This can save you time and reduce the chances of errors.

- Track Invoice Status: Keep a record of the invoices sent, their due dates, and the payment status. This helps you follow up on overdue payments and take necessary actions.

- Send Reminders: If a payment becomes overdue, send polite reminders to your clients. This can prompt them to make the payment and avoid any unnecessary delays.

- Organize Documents: Maintain a well-organized system for storing and retrieving invoices. This can include using digital folders or physical filing systems.

- Regularly Reconcile Payments: Reconcile your invoices with your bank statements to ensure that all payments have been received. This helps identify any discrepancies or potential issues.

- Seek Professional Help: If managing invoices becomes overwhelming, consider hiring a professional bookkeeper or accountant to assist you with your financial management.

Conclusion

A well-designed and efficiently managed cleaning service invoice is a valuable tool for any cleaning service business. It not only helps maintain professionalism but also ensures timely payments and efficient financial management. By understanding the importance of a cleaning service invoice, creating effective invoices, and implementing sound invoice management practices, you can streamline your invoicing process and focus on growing your business.

FAQs After The Conclusion

1. Can I use online invoicing software for creating cleaning service invoices?

Absolutely! Online invoicing software offers a range of features and benefits for creating and managing cleaning service invoices. It allows you to create professional-looking invoices, automate the invoicing process, and track payments more efficiently. Moreover, many invoicing software options offer customizable templates specifically designed for cleaning service businesses.

2. How should I handle late payments for cleaning service invoices?

Handling late payments requires a proactive approach. Start by sending polite payment reminders to your clients when a payment becomes overdue. If the payment is still not received, you may need to escalate the matter by sending formal demand letters or engaging a collection agency. It is important to have clear payment terms and consequences outlined in your terms and conditions to avoid any confusion.

3. Should I include discounts or promotions on my cleaning service invoices?

Including discounts or promotions on your cleaning service invoices can be an effective way to attract new clients or encourage repeat business. However, make sure to clearly communicate the terms and conditions of the discounts or promotions. This includes specifying the duration, eligibility criteria, and any limitations or restrictions that may apply.

4. Is it necessary to keep copies of the invoices I send?

Yes, it is essential to keep copies of the invoices you send for record-keeping purposes. Invoices serve as legal documents and can be used as evidence in case of disputes or audits. Makesure to save electronic copies of your invoices and organize them in a secure and easily accessible manner. This will help you track your financial transactions and provide documentation if needed.

5. Can I customize my cleaning service invoice template to include additional fields or information?

Yes, most invoice templates can be customized to suit your specific needs. You can add or remove fields, adjust the layout, and include any additional information that is relevant to your cleaning service business. However, it is important to ensure that the invoice remains clear, organized, and easy to understand for your clients.

6. How often should I send invoices to my cleaning service clients?

The frequency of sending invoices to your cleaning service clients will depend on your specific business arrangements. Some cleaning service providers prefer to send invoices after each completed service, while others may opt for weekly, bi-weekly, or monthly invoicing cycles. It is important to establish clear payment terms and communicate them to your clients to avoid any confusion regarding when and how often invoices will be sent.

7. What should I do if a client disputes the charges on my cleaning service invoice?

In the event of a dispute regarding the charges on your cleaning service invoice, it is important to address the issue promptly and professionally. Start by reviewing the details of the services provided and cross-reference them with any agreements or contracts you have with the client. If necessary, provide supporting documentation or evidence to justify the charges. Engage in open and honest communication with the client to understand their concerns and work towards a resolution that is fair for both parties.

8. How long should I keep copies of my cleaning service invoices?

It is generally recommended to retain copies of your cleaning service invoices for a minimum of six years. This ensures that you have a record of your financial transactions that aligns with legal and tax requirements. However, it is always a good idea to consult with a professional accountant or tax advisor to ensure compliance with specific regulations in your jurisdiction.

9. Can I use electronic signatures on my cleaning service invoices?

Yes, electronic signatures can be used on cleaning service invoices, provided they meet the legal requirements in your jurisdiction. Electronic signatures offer convenience and efficiency, allowing both you and your clients to sign invoices electronically without the need for physical documents. However, it is important to ensure that the electronic signature process complies with any applicable laws or regulations regarding electronic transactions and signatures.

10. How can I ensure the security and confidentiality of client information on my cleaning service invoices?

To ensure the security and confidentiality of client information on your cleaning service invoices, it is important to implement proper data protection measures. This includes using secure and encrypted invoicing software or platforms, regularly updating your software and systems to protect against security vulnerabilities, and implementing strong password protection practices. Additionally, it is essential to educate your staff about data privacy and confidentiality and establish protocols for handling and storing sensitive client information.