Managing payroll can be a complex and time-consuming task for businesses of all sizes. One crucial aspect of payroll management is ensuring that employees’ voluntary deductions, such as retirement contributions, health insurance premiums, and charitable donations, are accurately processed and accounted for. To streamline this process, companies often require employees to complete a payroll deduction authorization form. In this article, we will delve into the details of a payroll deduction authorization form, its purpose, benefits, and how to create an effective one.

What is a Payroll Deduction Authorization Form?

A payroll deduction authorization form, also known as a wage assignment form, is a document that allows employees to authorize their employers to deduct specific amounts from their paychecks for various purposes. These deductions can include but are not limited to:

- Retirement contributions (e.g., 401(k) or pension plans)

- Health insurance premiums

- Flexible spending account contributions

- Charitable donations

- Union dues

- Garnishments

The form serves as written consent from the employee, indicating their agreement to have the specified amounts deducted from their wages on a regular basis. It outlines the purpose of the deduction, the amount, and any other relevant details.

Why is a Payroll Deduction Authorization Form Important?

A payroll deduction authorization form plays a vital role in ensuring accurate and transparent payroll processing. Here are some key reasons why this form is important:

1. Compliance with Laws and Regulations

By using a payroll deduction authorization form, employers can ensure compliance with federal and state laws and regulations. For example, certain deductions may require specific employee consent under the Fair Labor Standards Act (FLSA) or state laws. The form serves as evidence of the employee’s consent and protects both parties from potential legal issues.

2. Clear Communication and Documentation

Using a payroll deduction authorization form promotes clear communication between employers and employees. It ensures that both parties have a shared understanding of the deductions being made and their purpose. The form also serves as written documentation for future reference, preventing any misunderstandings or disputes.

3. Efficient Payroll Processing

Having a standardized form for authorizing payroll deductions streamlines the payroll process. It provides the necessary information for the payroll department to accurately calculate and deduct the specified amounts from employees’ paychecks. This reduces the chances of errors and ensures timely and efficient payroll processing.

4. Employee Convenience

A payroll deduction authorization form offers convenience to employees by allowing them to choose and manage their voluntary deductions easily. By providing a clear and organized form, employees can clearly indicate their desired deductions, update them when necessary, and have control over their paycheck allocations.

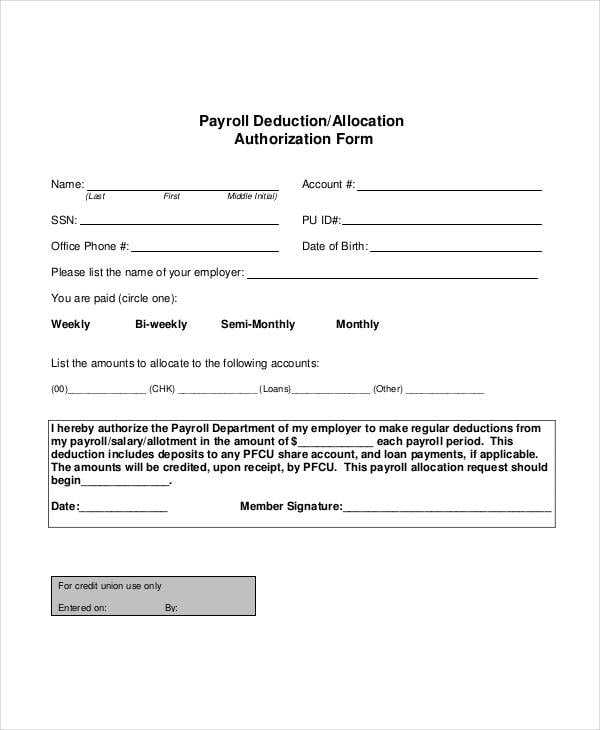

Key Elements of a Payroll Deduction Authorization Form

An effective payroll deduction authorization form should include the following key elements:

1. Employee Information

The form should include fields to capture essential employee information, such as full name, employee identification number, department, and contact details. This ensures that the form is properly associated with the correct employee’s records.

2. Authorization Details

The form should clearly state the purpose of the deduction and provide a description of the authorized deduction. This could include the name of the retirement plan, health insurance provider, charity organization, or any other relevant details. The form should also specify the amount or percentage to be deducted from each paycheck.

3. Frequency and Duration

The form should indicate the frequency of the deduction, such as weekly, bi-weekly, or monthly, along with the start and end dates, if applicable. This ensures that the deductions are consistent and align with the employee’s expectations.

4. Revocation and Amendment

It is important to include a section in the form that allows employees to revoke or amend their authorization. This ensures that employees have the flexibility to make changes to their deductions as needed. The form should specify the process and timeline for revoking or amending the authorization.

5. Employee Signature and Date

The form should include a space for the employee’s signature and the date of signing. This serves as the employee’s consent and acknowledgment of the authorized deductions.

Creating an Effective Payroll Deduction Authorization Form

Now that we understand the importance and key elements of a payroll deduction authorization form, let’s explore the steps to create an effective form:

1. Research Applicable Laws and Regulations

Before creating the form, research the federal and state laws and regulations that govern payroll deductions. This will ensure that your form is compliant and meets all necessary requirements. For example, certain deductions may require specific language or disclosures.

2. Identify the Purpose and Types of Deductions

Determine the purpose of the form and the types of deductions you want to include. Consider the voluntary deductions that your company offers, such as retirement plans, health insurance, and charitable contributions. This will help you tailor the form to your specific needs.

3. Design the Form

Design a clear and user-friendly form that includes all the key elements discussed earlier. Use headings, subheadings, and appropriate formatting to make the form easy to read and understand. Consider using checkboxes or drop-down menus to simplify the process for employees.

4. Seek Legal Review

Before finalizing the form, consult with your legal team or seek legal advice to ensure compliance with all applicable laws and regulations. They can review the form for any potential issues and suggest improvements if needed.

5. Communicate and Roll Out the Form

Once the form is finalized, communicate its purpose, benefits, and instructions to your employees. Provide clear guidelines on how to complete and submit the form. Consider hosting information sessions or providing FAQs to address any concerns or questions employees may have.

6. Regularly Review and Update

Payroll deduction needs may change over time due to various factors such as policy updates, legal requirements, or employee preferences. Regularly review and update the form to ensure it remains relevant and aligned with your company’s needs.

Conclusion

A payroll deduction authorization form is a crucial tool for businesses to streamline payroll processing and ensure compliance with laws and regulations. By using this form, employers can communicate clearly with employees, obtain their consent for voluntary deductions, and maintain accurate records. Creating an effective form involves careful consideration of key elements, compliance with laws, and clear communication with employees. By following these guidelines, companies can simplify their payroll management processes and enhance employee satisfaction.

FAQs After The Conclusion

1. Can an employer deduct wages without a payroll deduction authorization form?

No, in most cases, employers cannot deduct wages without proper authorization from the employee. It is essential to obtain written consent through a payroll deduction authorization form to comply with laws and regulations.

2. Can employees revoke or amend their payroll deduction authorization?

Yes, employees have the right to revoke or amend their payroll deduction authorization. The payroll deduction authorization form should include clear instructions on how employees can make changes or revoke their authorization.

3. Are there any limitations on the types of deductions that can be authorized through the form?

Yes, there may be limitations on the types of deductions that can be authorized through the payroll deduction authorization form. Some deductions may require specific legal requirements or restrictions. It is important to research and comply with applicable laws and regulations.

4. How long should employers retain payroll deduction authorization forms?

Employers should retain payroll deduction authorization forms for a specific period, typically based on legal requirements. Consult with legal counsel to determine the appropriate retention period for your business.

5. What should employers do if an employee refuses to complete a payroll deduction authorization form?

If an employee refuses to complete a payroll deduction authorization form, it is important to address the situation promptly. Engage in open communication with the employee to understand their concerns and explore alternative options if necessary. However, employers must comply with legal requirements and may need to take appropriate actions to ensure compliance with applicable laws and regulations.

Summary

A payroll deduction authorization form is a valuable tool for businesses to manage voluntary deductions from employees’ paychecks. It ensures compliance with laws and regulations, promotes clear communication, streamlines payroll processing, and offers convenience to employees. Creating an effective form involves understanding the key elements, complying with legal requirements, and communicating with employees. By implementing a well-designed form, companies can enhance their payroll management processes and strengthen their employer-employee relationships.